A lack of liquidity can lead to bankruptcy, even with otherwise viable companies

Here goes the explanation

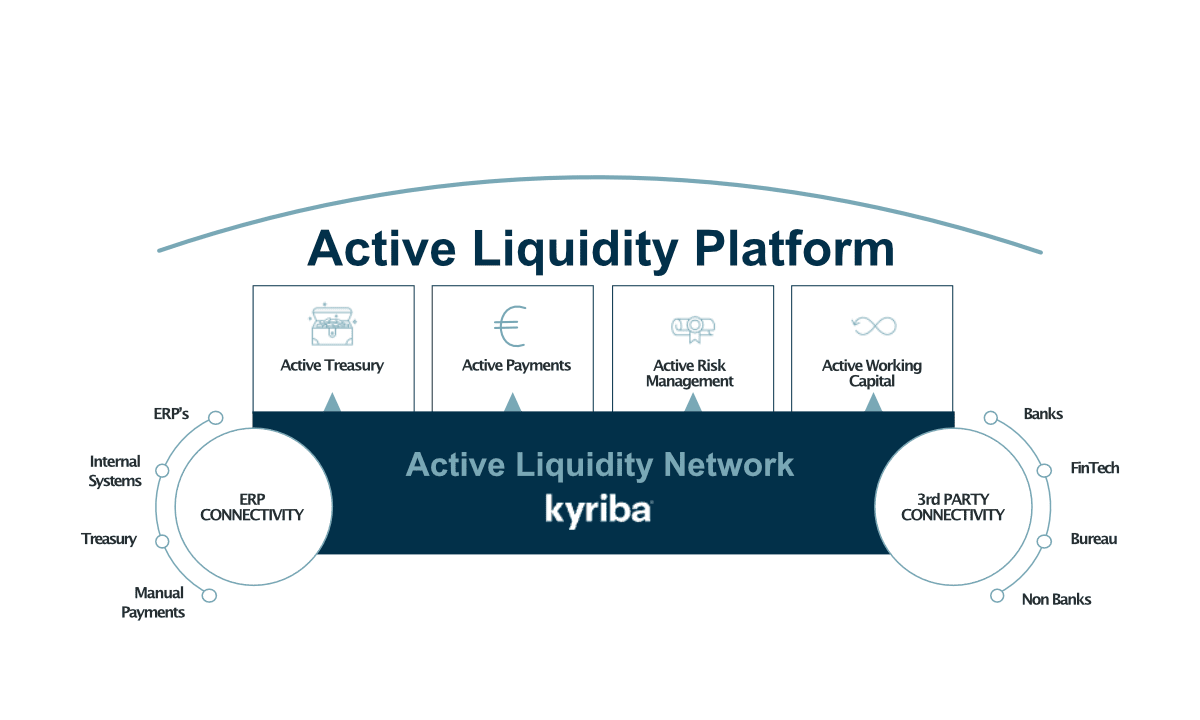

Markets have become extremely volatile and unpredictable. The business leaders expect the CFO to provide accurate, timely insights. New developments require new reports and analysis, putting relentless pressure on the finance team. The Active Liquidity Platform takes away the effort to produce real-time and reliable reports, freeing up time to analyze and advise with confidence.

Reliable insights require accurate views on all cash movements. There is no time for manual consolidations or reconciliations, the Finance teams must have full transparency at all times. The Active Liquidity network allows to centralize all payments in one platform, saving time and reducing risks.

Visibility leads to transparency, resulting in improved risk management. The Active Liquidity Platform allows CFO’s to improve working capital and offers an opportunity to increase net income.

Working with Jedox, I can review and analyze results with the different subsidiaries and, as a group CEO, steer and make informed decisions with full transparency. I would never want to return to how we worked before implementing Jedox.