Economic turmoil increases Fraud Levels

Share on Twitter Tweet

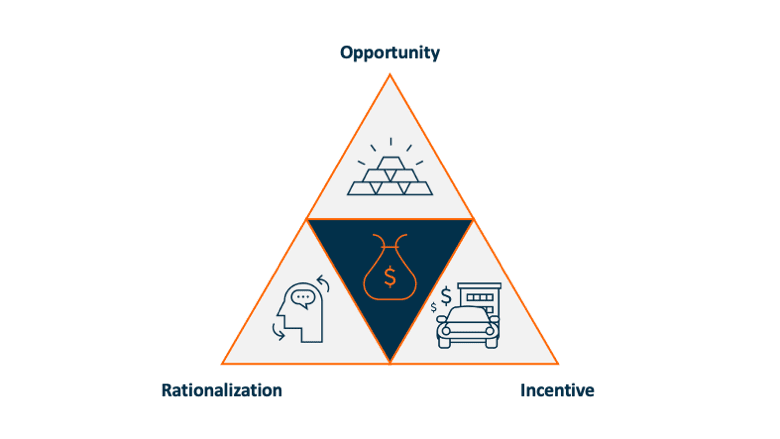

After researching the circumstances that led embezzlers to temptation, Donald R. Cressey developed the Fraud Triangle. He found out that for fraud to occur, three elements must be present: opportunity, incentive (or pressure) and rationalization.

The past has shown that turbulent times have increased the risk of fraud. As companies are struggling to stay afloat, employees might be perceiving increased pressure: pressure from management, but also from clients and/or suppliers could lead to stress. People might fear the risk of restructuring due to cost cutting initiatives. This economic uncertainty triggers people to move cash out of the organization for personal gain.

Since the Covid-pandemic has hit the world, remote work has become the norm. And while this has offered numerous advantages, this new way of working has also created some challenges. Many firms already had home working policies in place, yet others did not. Companies with a strong hierarchy and traditional sign-off procedures are extra vulnerable as they are not organized for remote working.

The economic pressure and uncertainty resulting from COVID combined with the disruption of daily routines are the ideal setting for increased fraud, and you should be fortifying your defenses.

Did you notice a surge in fraud attempts? How do you protect your organization?

Let's grab coffee and discuss how I can help you strengthen your defenses.