Up to 88% of the demand for Li-ion batteries will come from the automotive market.

Share on Twitter Tweet

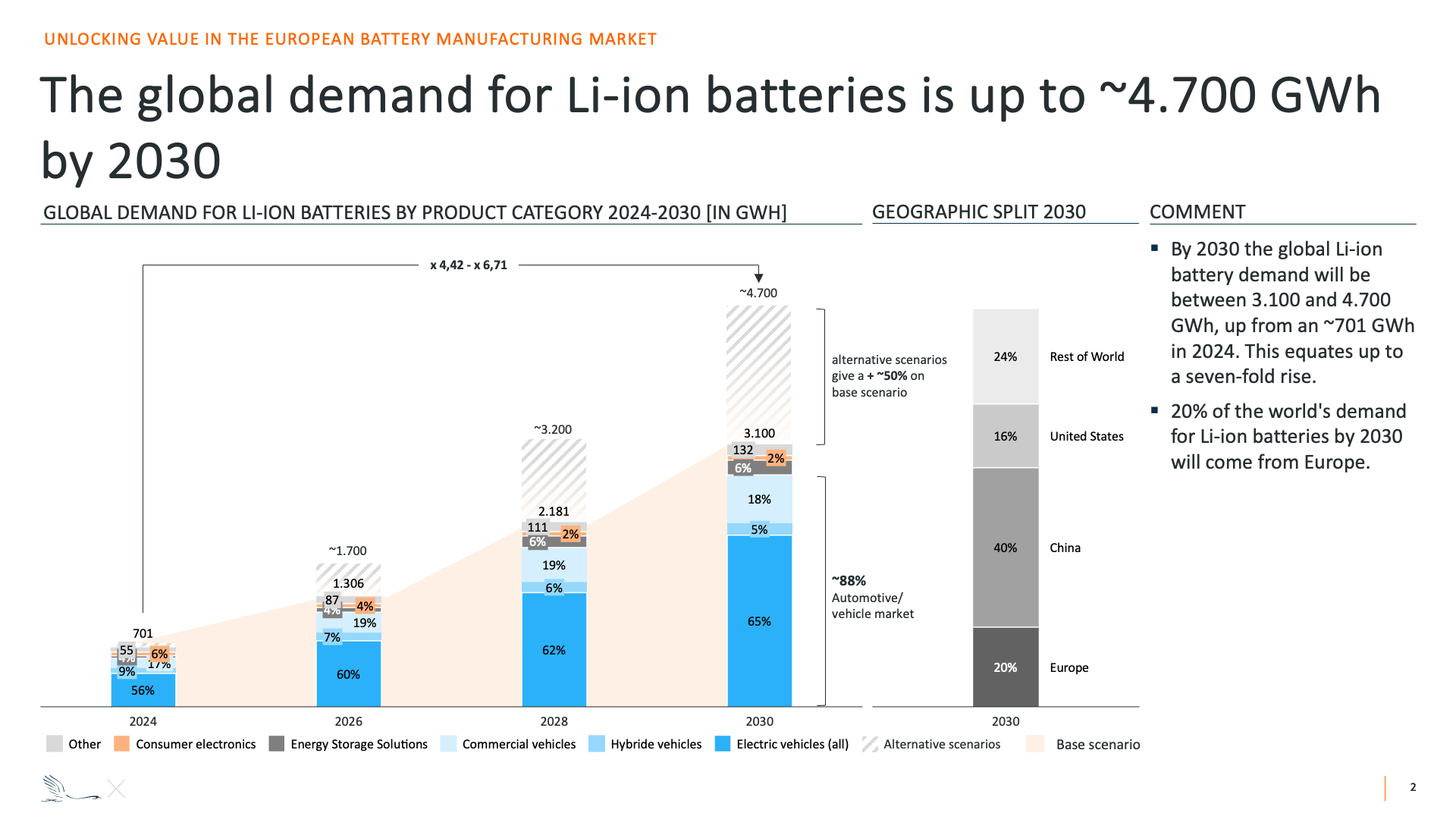

By 2030, the global Li-ion battery demand will be between 3.100 and 4.700 GWh, up from 701 GWh in 2024. By then, 20% (940 GWh) of the world's demand for Li-ion batteries is expected to come from Europe, and up to 88% of the demand will come from the automotive market (65% full electric vehicles, and 23% of hybrid and commercial vehicles).

NX Elicit explored the European battery manufacturing market and it’s capacity to address this exploding demand.

As the world moves to an increased number of sustainable alternatives, NX Elicit explored one of the crucial industries enabling this transition being the European battery manufacturing market.

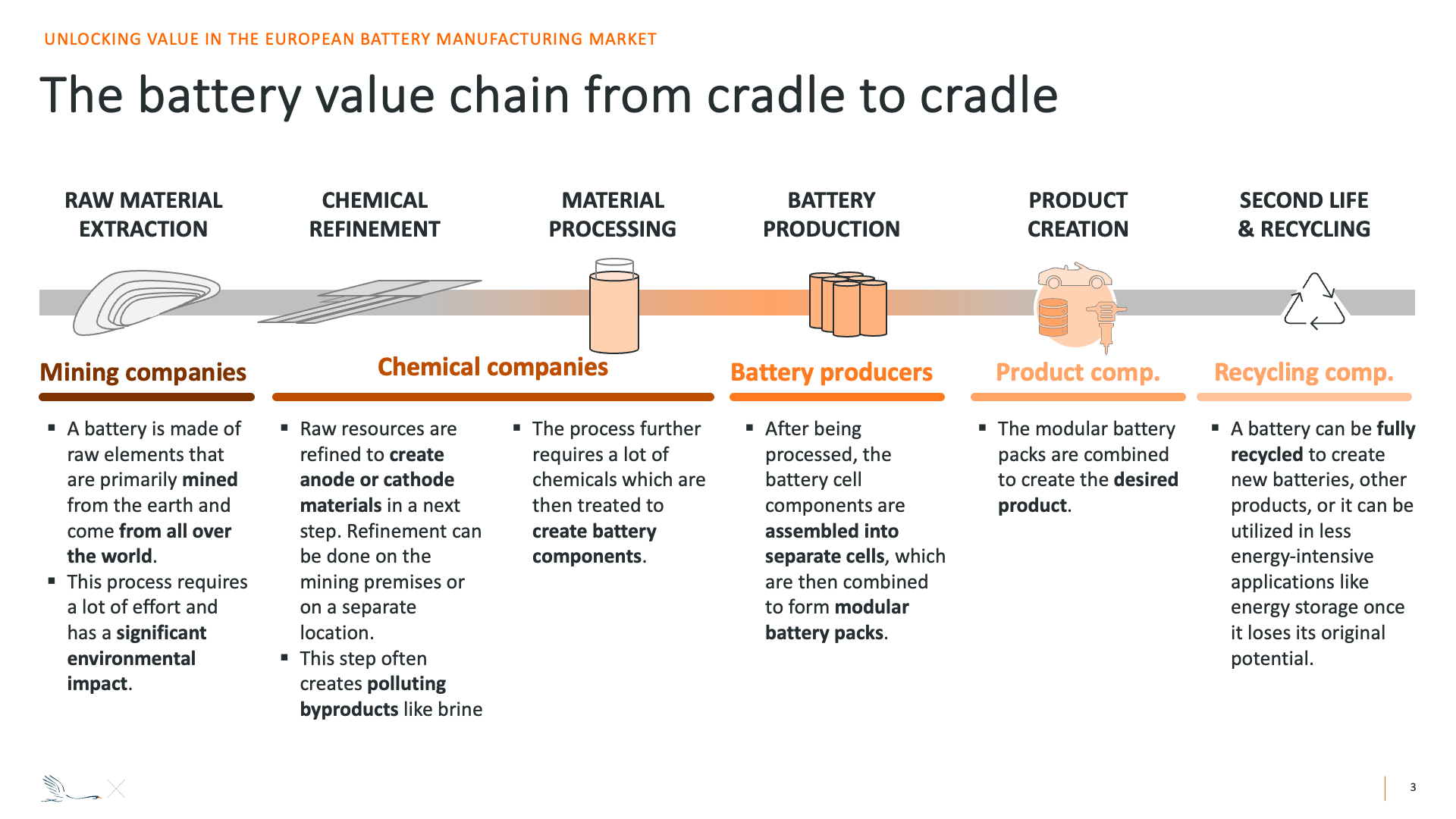

The battery value chain consists of six phases, from raw material mining over production to recycling, hence allowing application from cradle to cradle. Currently, no single business controls the full value chain due to the large number and complexity of processes. For this story, we will explore the manufacturing market.

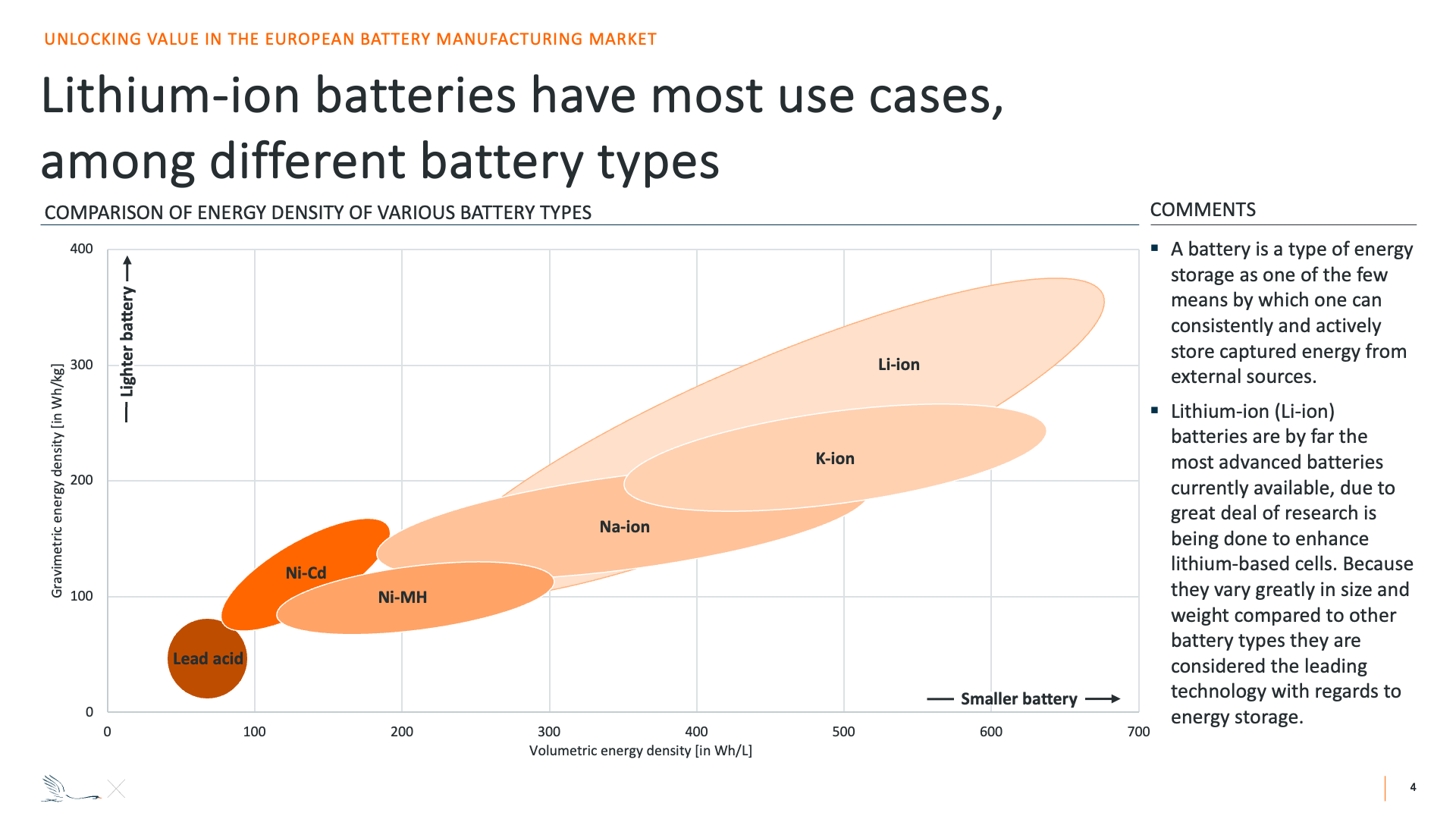

The automotive industry covers the largest portion of the demand for batteries, particularly with the rise of electric vehicles. Lithium-ion (Li-ion) batteries are by far the most advanced batteries currently available for this application and scale due to their high energy density compared to other types of batteries. Other types, such as glass batteries and solid-state batteries, are essentially used in smaller-scale applications.

By 2030, the global Li-ion battery demand will be between 3.100 and 4.700 GWh, up from 701 GWh in 2024. By then, 20% of the world's demand for Li-ion batteries is expected to come from Europe, and up to 88% of the demand will come from the automotive market (65% full electric vehicles and 23% hybrid and commercial vehicles).

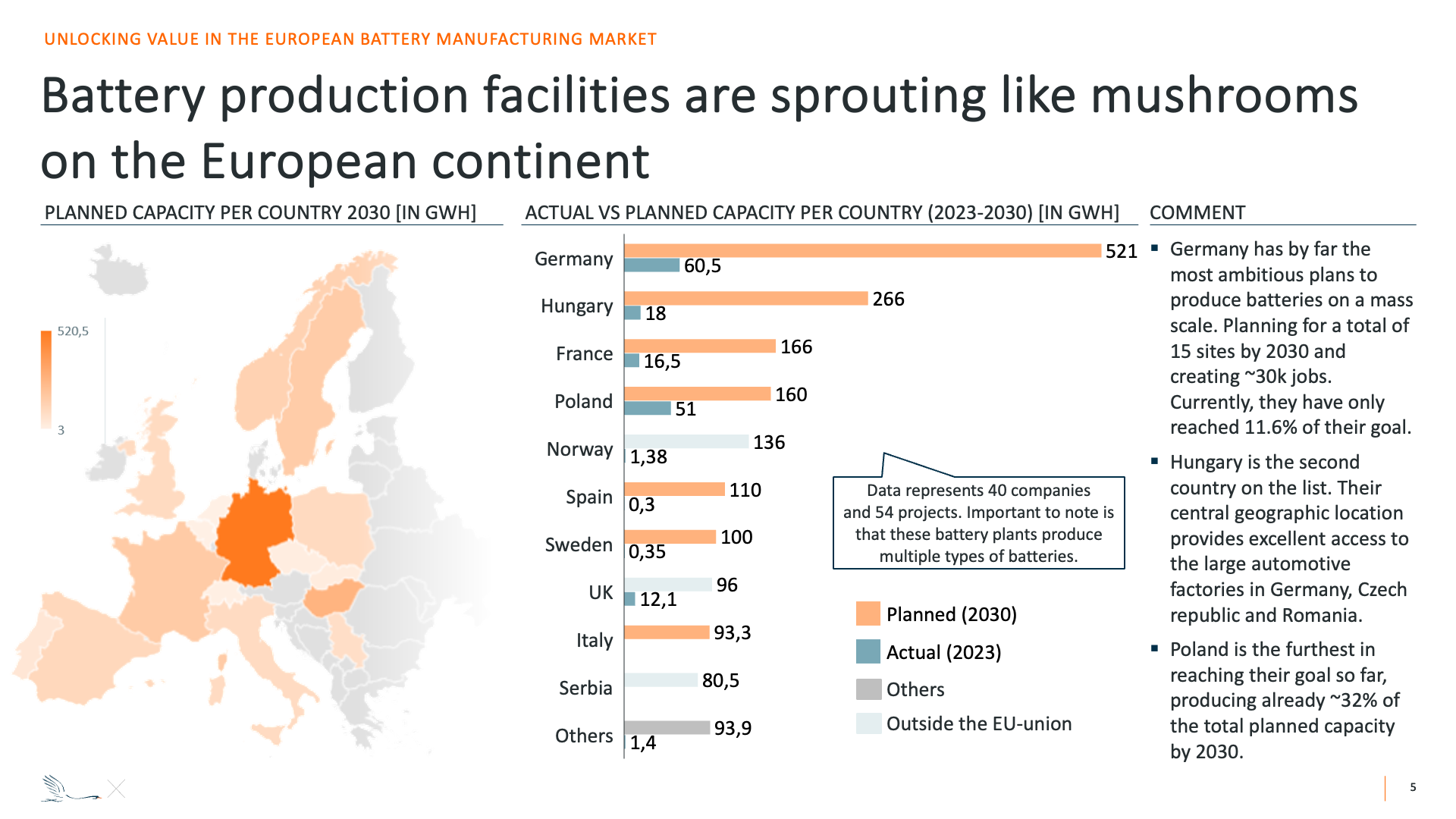

For this reason, and with the objective of nearshoring battery production, the European continent is getting ready for a global battery competition. Germany is the leading country with plans to increase its capacity eightfold over the next seven years. This is mainly related to the vast number of automakers in the area.

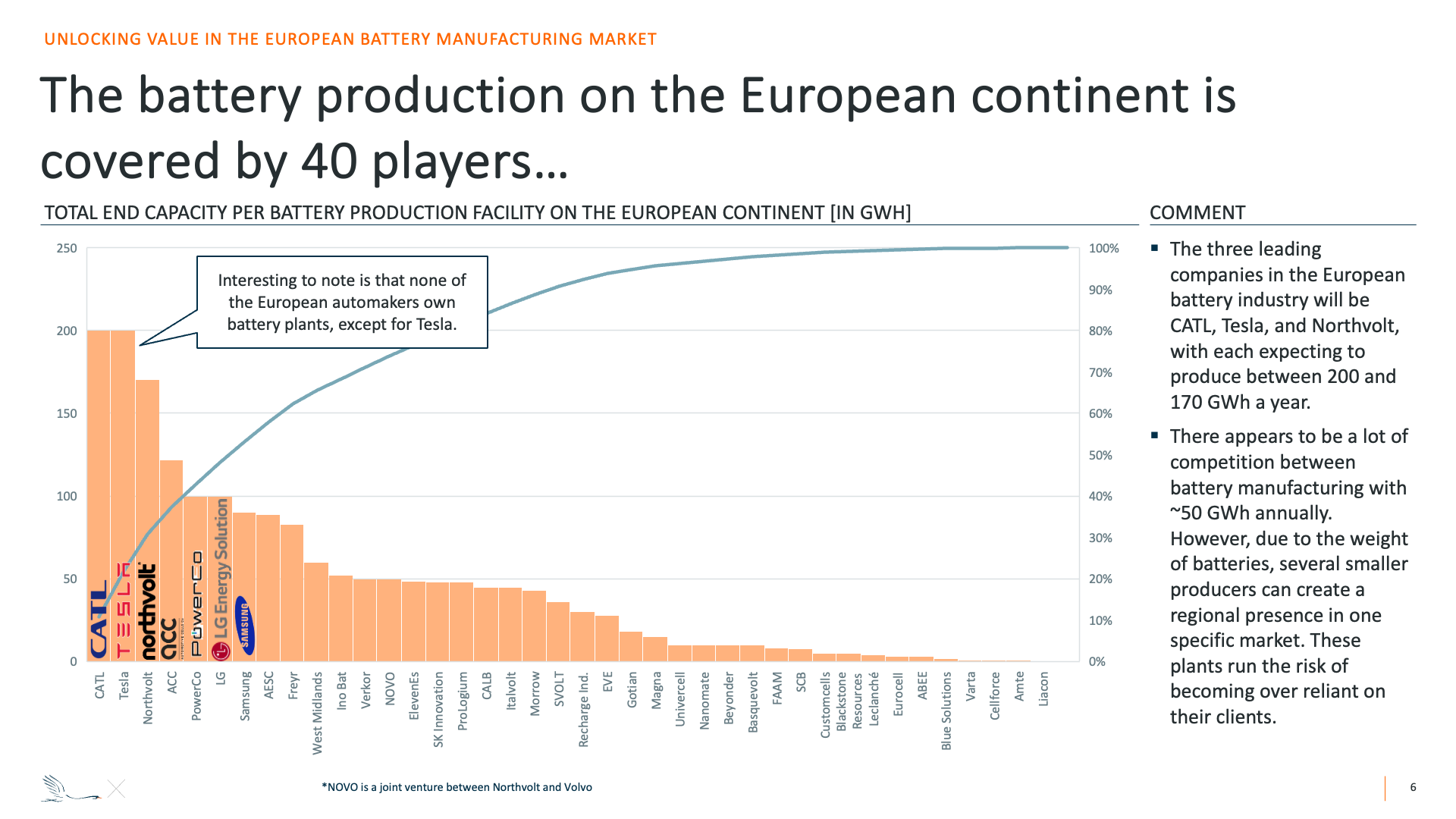

Today, however, the battery production industry is still in its early stages of growth; forty businesses on the European continent are building battery factories or vying for market share. In the end phase of their production rollout, the five largest production facilities will produce 43,5% of all battery production capacity in Europe (across all battery types).

Now, how do we value this industry? There are three occasions when one could value their battery manufacturing facility:

With NX Partners, we have looked into the metrics of valuation and found the company’s ambition or battery capacity, investment per GWh, and FTEs per GWh to be leading parameters.

Interested to know if your valuation aligns with our database's research or just obtain more information on the market (e.g. supply, business models, strategic groups, shareholder structure, recycling activities, growth opportunities,… )?

Please reach out! We at NX Partners welcome the opportunity to connect with you!